The best senior health insurance in the USA combines Medicare, Medicare Advantage, or Medigap, depending on your health needs, lifestyle, and budget. Seniors should compare premiums, out-of-pocket costs, provider flexibility, and extra benefits like prescription drugs, dental, and vision before enrolling.

Why is this important? By age 65, nearly 80% of seniors have at least one chronic condition (CDC, 2024). Without the right insurance, medical bills can quickly become overwhelming. For example, a single hospital stay can cost more than $13,000, but with Medicare Part A, most seniors pay little or nothing out-of-pocket for covered days.

This guide will walk you through:

- Medicare and private insurance options

- 2025 costs and policy updates

- The differences between Medigap and Medicare Advantage

- Top insurance providers ranked for seniors

- Tips and FAQs to help you confidently choose coverage

👉 Always review official Medicare.gov information before enrolling.

What Is Senior Health Insurance?

Senior health insurance in the U.S. primarily means Medicare, which starts at age 65. But Medicare has gaps—like prescription drugs, dental, and vision—that many seniors still need. That’s why private insurers offer two popular add-ons: Medicare Advantage and Medigap (Supplemental Insurance).

Main Types of Coverage:

- Original Medicare (Parts A & B)

Covers hospital stays, outpatient visits, preventive care, and lab tests. Does not cover most prescriptions, dental, or hearing aids. - Medicare Advantage (Part C)

Private companies approved by Medicare provide bundled plans. These often include Part D (prescriptions) and extras like dental, vision, and gym memberships. - Medigap (Medicare Supplement Plans A–N)

Sold by private insurers. Pays for costs that Medicare doesn’t—like coinsurance, copays, and deductibles. Offers flexibility to see any provider nationwide that accepts Medicare. - Part D (Prescription Drug Coverage)

Covers medications. Critical for seniors managing conditions like diabetes, hypertension, or arthritis.

👉 Real-world example: Mary, 72, living in Florida, takes multiple medications for arthritis. If she only had Original Medicare, her monthly out-of-pocket drug costs would be $450+. With a Medicare Advantage plan including Part D, her prescriptions dropped to $65/month.

Medicare Costs in 2025

Understanding costs is essential. Medicare isn’t free—it comes with premiums, deductibles, and coinsurance. Here are the updated 2025 figures (CMS, Kiplinger 2025):

Part A (Hospital Coverage)

- Premium: $0 for most seniors (if you paid Medicare taxes 10+ years)

- Deductible: $1,676 per benefit period

- Hospital Stays:

- Days 1–60: $0 coinsurance

- Days 61–90: $419 per day

- Days 91+: $838 per “lifetime reserve day”

Part B (Medical Coverage)

- Monthly Premium: $185

- Annual Deductible: $257

- Coinsurance: 20% of most services after deductible

Part C (Medicare Advantage)

- Average Premium: $17/month

- Many plans at $0 premium but may have copays and network restrictions

- Must still pay Part B premium

Part D (Drug Coverage)

- Average Premium: $46.50

- Out-of-Pocket Cap: $2,000 (new in 2025, improving affordability for seniors with expensive prescriptions)

👉 Practical Tip: If you take brand-name drugs, always check if your plan covers them under a preferred tier to avoid surprise costs.

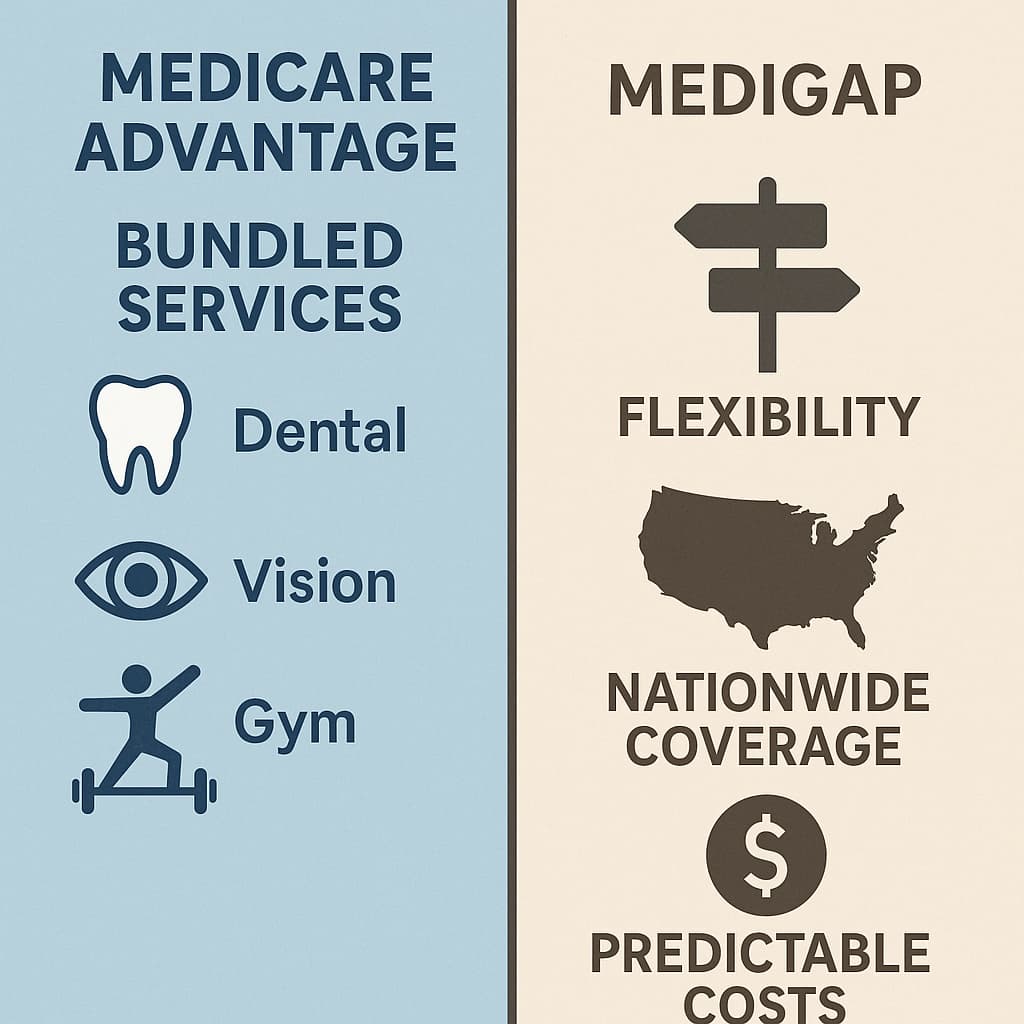

Medicare Advantage vs. Medigap: Which Is Better?

Choosing between Medicare Advantage and Medigap is the biggest decision seniors face.

Medicare Advantage (Part C)

✅ Pros:

- Often $0 premium (in addition to Part B premium)

- Bundled with Part D, vision, dental, hearing

- Annual out-of-pocket maximum ($8,850 in 2025)

- Extras like SilverSneakers gym membership

❌ Cons:

- Limited provider networks (HMO/PPO)

- Referrals may be required for specialists

- Coverage varies by state and county

👉 Example: John, 68, travels between Texas and Arizona every winter. He found Medicare Advantage restrictive since he couldn’t always use his preferred doctors out of state. He switched to Medigap for nationwide flexibility.

Medigap (Medicare Supplement)

✅ Pros:

- Works with Original Medicare everywhere in the U.S.

- Predictable, low out-of-pocket costs

- No network restrictions

❌ Cons:

- Higher monthly premiums ($120–$200/month depending on plan)

- Does not include Part D (must buy separately)

- Dental and vision still excluded

👉 Tip: Medigap is excellent for seniors with frequent hospital visits or those who travel often, while Medicare Advantage is great for those seeking lower upfront costs with bundled extras.

Best Senior Health Insurance Companies in 2025

Choosing the right provider is just as important as choosing between Medicare Advantage and Medigap. While many insurers offer plans, only a few consistently rank at the top for affordability, coverage, and satisfaction. Below are the best senior health insurance companies in 2025, along with their official websites for easy access.

1. AARP/UnitedHealthcare

Best for overall value and nationwide availability

AARP, in partnership with UnitedHealthcare, is the largest Medicare Advantage and Medigap provider in the United States. It’s a trusted brand among seniors because of its affordable premiums, reliable coverage, and nationwide reach.

- Coverage Options: Offers both Medicare Advantage and Medigap, plus Part D prescription plans.

- Perks: Discounts on wellness programs, gym memberships, and preventive care through AARP.

- Availability: Available in all 50 states.

- Why Seniors Like It: Stability, reliable customer service, and wide access to doctors.

👉 Website: aarpmedicareplans.com

2. Kaiser Permanente

Best for affordability and integrated care

Kaiser Permanente is well-known for combining insurance with its own hospitals and doctors, creating a seamless healthcare experience. Its integrated system helps reduce costs and improve outcomes.

- Coverage Options: Medicare Advantage with prescription drugs, preventive services, and extras.

- Strengths: Top-rated by J.D. Power and CMS for quality and satisfaction.

- Availability: Limited to specific regions (CA, CO, GA, OR, WA, HI, MD, VA, DC).

- Why Seniors Like It: Affordable premiums and consistently high-quality care.

👉 Website: healthy.kaiserpermanente.org/medicare

3. Aetna

Best for chronic condition management

Owned by CVS Health, Aetna offers Medicare Advantage plans designed to support seniors with chronic conditions such as diabetes, heart disease, or COPD. It also ranks well for customer service and affordability.

- Coverage Options: Medicare Advantage, some Medigap, and Part D drug plans.

- Strengths: Telehealth, nurse hotlines, and chronic care programs.

- Customer Satisfaction: Lower-than-average complaint rates (NAIC).

- Why Seniors Like It: Affordable premiums and strong support for ongoing health needs.

👉 Website: aetnamedicare.com

4. Molina Healthcare

Best for low-cost Medicare Advantage

Molina Healthcare focuses on affordability, making it a great choice for budget-conscious seniors who still want comprehensive coverage.

- Coverage Options: Primarily Medicare Advantage with prescription drug coverage.

- Strengths: Very low or $0 premiums, strong affordability.

- Availability: Limited to select states, but expanding.

- Why Seniors Like It: Essential benefits at some of the lowest prices available.

👉 Website: molinahealthcare.com

5. Blue Cross Blue Shield (BCBS)

Best for nationwide coverage and flexibility

Blue Cross Blue Shield consists of independent companies across the U.S., making it one of the most widely available options for Medicare Advantage and Medigap.

- Coverage Options: Medicare Advantage, Medigap, and Part D plans.

- Strengths: Large provider network, local support, and broad availability.

- Flexibility: Excellent for seniors who travel or live part of the year in different states.

- Why Seniors Like It: A trusted brand with consistent coverage across the country.

👉 Website: bcbs.com/medicare

Final Takeaway

Each of these companies has unique strengths:

- AARP/UnitedHealthcare and BCBS → Best for nationwide availability and trusted service.

- Kaiser Permanente and Molina Healthcare → Best for affordability and value.

- Aetna → Best for seniors managing chronic conditions.

👉 According to Investopedia (2025), these companies consistently rank highest for affordability, satisfaction, and coverage.

Comparison Table: Senior Health Insurance Options (2025)

| Plan Type | What It Covers | Best For | Estimated Cost |

|---|---|---|---|

| Original Medicare (A & B) | Hospital + outpatient, no drug coverage | Basic safety net | $185 Part B premium + deductibles |

| Medicare Advantage (C) | A+B+D + extras (dental, vision) | Budget-conscious seniors | $0–$50/month (avg. $17) |

| Medigap + Part D | Fills Medicare gaps + prescriptions | Frequent travelers, high healthcare users | $120–$200/month + Part D premium |

Practical Tips for Choosing the Best Plan

- List Your Medications: Use Medicare’s Plan Finder to estimate yearly costs.

- Check Doctor Networks: If you love your current doctor, make sure they accept your chosen plan.

- Don’t Skip Preventive Benefits: Look for plans that include wellness screenings, vaccinations, and fitness.

- Plan for the Future: If you expect long-term conditions, Medigap often saves money long-term.

- Consider Travel: Snowbirds or frequent travelers should avoid Advantage HMOs with strict networks.

FAQs About Senior Health Insurance (2025)

1. What is the cheapest senior health insurance?

Medicare Advantage plans with $0 premium are the cheapest, but out-of-pocket costs can add up.

2. Which is better for seniors: Medicare Advantage or Medigap?

If you want low premiums and bundled extras, choose Advantage. If you want flexibility and cost predictability, choose Medigap.

3. Does Medicare cover dental and vision?

Not under Original Medicare. Only some Medicare Advantage plans include them.

4. Can I switch from Medicare Advantage to Medigap?

Yes, during the Annual Enrollment Period (Oct. 15–Dec. 7). Outside this, switching is harder.

5. What is the new drug cap for seniors in 2025?

Part D now has a $2,000 annual out-of-pocket limit, a major benefit for seniors with costly prescriptions.

6. Which company has the best senior insurance nationwide?

AARP/UnitedHealthcare and BCBS are most widely available across the U.S.

7. What about long-term care or nursing homes?

Medicare does not cover most long-term care. Seniors may need Medicaid or private long-term care insurance.

Conclusion

The best senior health insurance in the USA is not one-size-fits-all.

- If you want affordable coverage with extras, Medicare Advantage is a smart choice.

- If you want flexibility and predictable costs, Medigap + Part D is the best long-term solution.

- Always compare premiums, networks, and prescription drug coverage before enrolling.

👉 Visit Medicare.gov to compare personalized options in your ZIP code and make the best decision for your health and finances.