A Medicare Flex Card is a prepaid debit card benefit available only through certain Medicare Advantage (Part C) plans—not through Original Medicare. Seniors can use it for approved health and wellness-related expenses like groceries, dental, vision, hearing services, utilities, and over-the-counter medicines.

Understanding the Flex Card is important because it’s often misunderstood or advertised incorrectly. While it can be valuable, not all seniors qualify, and its availability depends on the Medicare Advantage plan you choose. In this guide, we’ll explain exactly what the Medicare Flex Card is, its benefits, eligibility, and how you can get one safely.

What Is a Medicare Flex Card?

The Medicare Flex Card is a prepaid debit card provided by private insurers as an extra benefit under select Medicare Advantage plans.

- It’s not a government-issued free card and doesn’t come with Original Medicare (Parts A & B).

- The card comes preloaded with funds, typically ranging from $250 to $1,500 annually, depending on the plan. The average benefit for 2025 is around $996 (Axios).

- Funds may be loaded monthly, quarterly, or yearly, and unused amounts usually expire at the end of the period.

What Can Seniors Use the Flex Card For?

The spending categories vary by insurer, but common eligible expenses include:

- Over-the-counter (OTC) items: medications, vitamins, personal care supplies

- Dental, hearing, and vision costs: copayments, eyeglasses, dentures, or hearing aids

- Groceries & healthy food: often at participating stores

- Utilities: electricity, gas, internet, and phone bills

- Fitness expenses: gym memberships, classes, or equipment

- Assistive devices: walkers, shower chairs, mobility aids

- Transportation: rides to medical appointments (on some plans)

➡️ Example: Anthem’s Everyday Options Flex Card allows spending on groceries, OTC, utilities, and dental/vision/hearing costs in one combined account (Anthem Medicare).

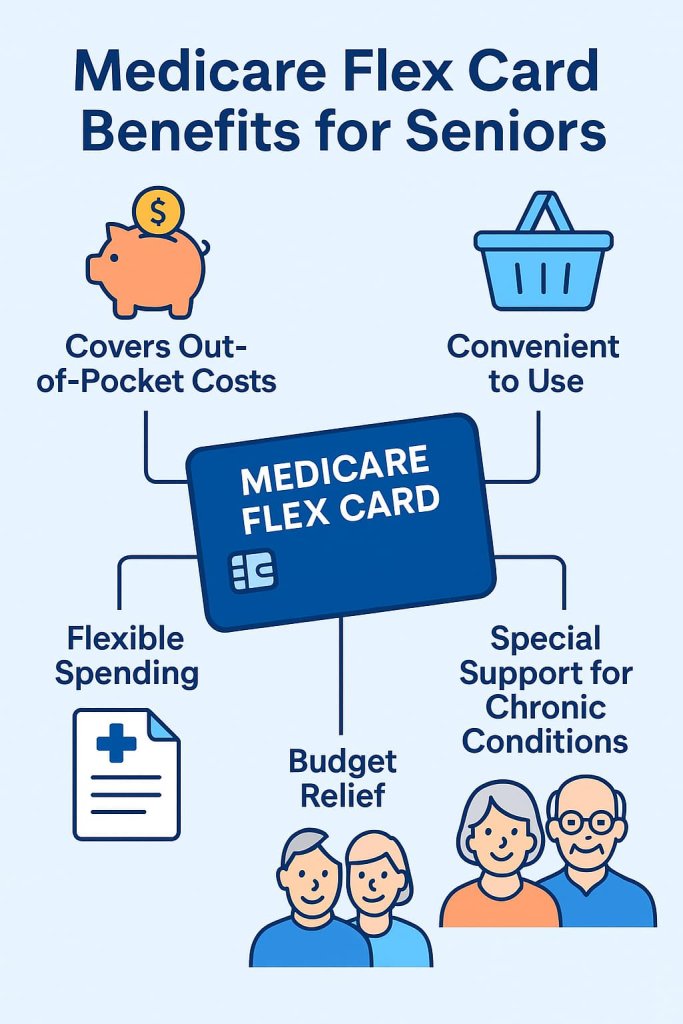

Medicare Flex Card Benefits for Seniors

- Covers Out-of-Pocket Costs – Helps reduce financial pressure by paying for essential health and wellness items.

- Convenient to Use – Works like a debit card at approved vendors; no need for reimbursement paperwork.

- Flexible Spending – Depending on the plan, seniors can use funds across multiple categories (groceries, utilities, OTC).

- Special Support for Chronic Conditions – Some plans offer enhanced benefits for seniors with chronic illnesses or those who are dual-eligible (Medicare + Medicaid).

- Budget Relief – Helps seniors on fixed incomes stretch their healthcare and living budgets.

Eligibility Requirements

To qualify for a Medicare Flex Card, you must meet Medicare’s base rules and choose a Medicare Advantage plan that specifically includes this benefit. Use the checklist and details below to confirm your eligibility.

1) Be Eligible for Original Medicare (Parts A & B)

- Standard eligibility: Most people qualify at age 65.

- Under 65 eligibility: You may qualify earlier if you have:

- A qualifying disability and receive SSDI benefits (typically 24 months),

- ALS (Lou Gehrig’s disease), or

- End-Stage Renal Disease (ESRD).

Learn more: Medicare.gov – Get started with Medicare

2) Citizenship & Residency

- You must be a U.S. citizen or a lawful permanent resident who has lived in the U.S. for at least five consecutive years.

3) Enroll in a Medicare Advantage (Part C) Plan That Offers a Flex Card

- The Flex Card is not available through Original Medicare (Parts A & B) or Medigap.

- It is only offered as an extra benefit by certain Medicare Advantage plans and can vary by insurer and state/region.

- Confirm the Flex Card categories (e.g., OTC, groceries, utilities, dental/vision/hearing), load amounts, and usage rules in the plan’s Summary of Benefits.

Compare plans: Medicare.gov Plan Finder | Overview: NCOA – Flex Card for Medicare

4) Meet Any Plan-Specific Requirements (If Applicable)

- Some Flex Card benefits are limited to Special Needs Plans (SNPs):

- D-SNP (Dual Eligible SNP): For people who have both Medicare and Medicaid.

- C-SNP (Chronic Condition SNP): For people with specific chronic conditions (e.g., diabetes, cardiovascular disorders). Eligible conditions vary by plan.

- Insurers may require documentation to verify Medicaid status (for D-SNP) or qualifying conditions (for C-SNP).

About SNPs: Medicare.gov – Special Needs Plans

5) Live in the Plan’s Service Area

- You must reside in the service area of the Medicare Advantage plan offering the Flex Card. If you move out of the service area, you may qualify for a Special Enrollment Period to change plans.

6) Enroll During a Valid Enrollment Window

- Initial Enrollment Period (IEP): The 7-month window around your 65th birthday.

- Annual Enrollment Period (AEP): October 15 – December 7 each year.

- Special Enrollment Period (SEP): Triggered by qualifying life events (e.g., moving, losing other coverage, gaining Medicaid eligibility).

Quick Eligibility Checklist

- I qualify for Original Medicare (A & B).

- I am a U.S. citizen or lawful permanent resident (5+ consecutive years).

- I live in the service area of a Medicare Advantage plan that includes a Flex Card.

- Any required SNP criteria (D-SNP or C-SNP) are met and documented (if applicable).

- I can enroll now (IEP, AEP, or an SEP applies).

Bottom line: A Medicare Flex Card is only available through select Medicare Advantage plans. Confirm you meet Medicare’s base eligibility, live in the plan’s service area, and—if required—qualify for the SNP type the plan uses to offer the Flex Card benefit.

How Do You Get a Medicare Flex Card?

Getting a Medicare Flex Card isn’t automatic—you must actively choose the right type of Medicare plan and follow the proper steps. Here’s the detailed process:

1. Check Your Eligibility for Medicare

- Before you can get a Flex Card, you must qualify for Original Medicare (Parts A & B).

- Most people become eligible at age 65.

- Some qualify earlier if they have a disability, ALS (Lou Gehrig’s disease), or End-Stage Renal Disease (ESRD).

- You must also be a U.S. citizen or a legal permanent resident who has lived in the U.S. for at least five consecutive years.

2. Compare Medicare Advantage Plans

- The Flex Card is not part of Original Medicare or Medigap. It’s only offered by select Medicare Advantage (Part C) plans.

- Use the official Medicare Plan Finder to search for plans in your area.

- Compare plan details carefully, because:

- Not all Medicare Advantage plans include a Flex Card.

- Some insurers restrict the benefit to people with chronic conditions or those dually eligible for Medicare and Medicaid.

- You can also consult a licensed insurance agent or your local State Health Insurance Assistance Program (SHIP) for free guidance.

3. Enroll During the Correct Enrollment Period

You can’t sign up at just any time—you must enroll during an official enrollment window:

- Initial Enrollment Period (IEP): Begins 3 months before your 65th birthday, includes your birthday month, and lasts 3 months after.

- Annual Enrollment Period (AEP): Runs from October 15 to December 7 each year. This is when most people switch or add plans.

- Special Enrollment Period (SEP): Available if you experience a qualifying life event such as moving to a new state, losing employer coverage, or becoming eligible for Medicaid.

4. Receive and Activate Your Flex Card

- Once you choose a Medicare Advantage plan that offers a Flex Card, the insurance company will send you the card.

- Some insurers mail it automatically before your plan coverage begins. Others require you to activate it online or by phone.

- Your plan will provide instructions on:

- How much money is preloaded

- How often funds are added (monthly, quarterly, annually)

- Where you can use the card

5. Start Using Your Flex Card

- The card works like a prepaid debit card, but it only covers eligible expenses.

- Typical approved categories include OTC medications, groceries, dental/vision/hearing services, utilities, and fitness programs.

- You can use it at participating retailers, pharmacies, and healthcare providers (each plan has its own network).

- Track your spending and balance using:

- The insurer’s mobile app

- Online member portal

- Monthly account statements

✅ Pro Tip: Unused funds usually do not roll over—so make sure to use the benefit before the period ends.

Limitations and Things to Watch Out For

- Not Available with Original Medicare or Medigap – Only through select Advantage plans.

- Funds Expire – No rollover at the end of the month, quarter, or year.

- Restricted Vendors – Can’t be used everywhere; only at participating retailers and providers.

- Scams Alert – Beware of ads promising “free Medicare Flex Cards.” The government does not give them away; they come only through insurers (NCOA).

FAQ: Medicare Flex Card for Seniors

1. Does Original Medicare offer a Flex Card?

No. Only certain Medicare Advantage plans provide them.

2. How much money is on a Medicare Flex Card?

Amounts vary—anywhere from $250 to over $1,500 per year, depending on the plan.

3. Can I use the Flex Card for groceries?

Yes, but only at approved retailers and depending on your plan’s rules.

4. Do Flex Card funds roll over?

Usually not—unused funds typically expire at the end of the coverage period.

5. How do I know if I qualify for one?

Check your Medicare Advantage plan’s benefits or use Medicare’s Plan Finder.

6. Can I get cash from my Flex Card?

No. It doesn’t work like an ATM card; it only covers eligible expenses.

7. Is the Flex Card available in every state?

No. Availability depends on the insurance provider and region.

Conclusion

The Medicare Flex Card can be a helpful tool for seniors looking to cover everyday healthcare and wellness expenses. But it’s only available through certain Medicare Advantage plans, not Original Medicare. To get one, you must enroll in a qualifying plan during the correct enrollment period and use the card only for eligible items and services.

Bottom line: If you’re exploring Medicare Advantage, consider whether a plan with a Flex Card benefit fits your healthcare and financial needs—but always review the fine print.

👉 Compare plans on Medicare.gov or talk to a licensed advisor to find out if a Medicare Flex Card is available in your area.